Tokenomics

$INSUR, a standard ERC20 token, is the InsurAce protocol's governance token which is also used to incentivize participation in the ecosystem.

The current use cases for $INSUR tokens are as follows:

Representation of voting rights in community governance such as claim assessment, proposal voting, etc.

Mining incentives for capital provisions to the mining pool and investment products.

Eligibility to earn fees generated by InsurAce.io through governance participation.

Community and ecosystem incentives.

As the InsurAce protocol develops, more use cases will be introduced for the $INSUR token.

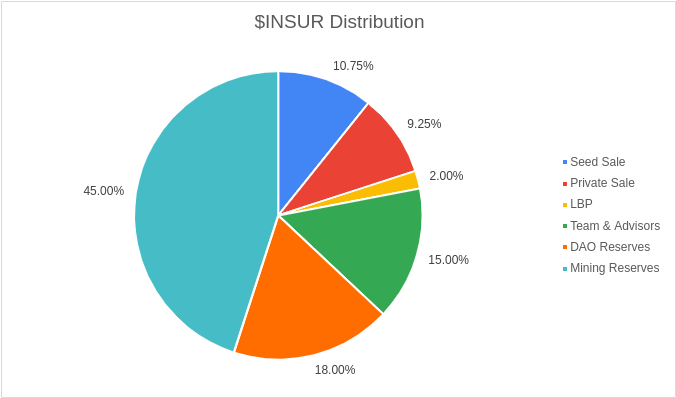

$INSUR token supply and allocation

Total supply: 100M $INSUR

The above token distribution plan may be subject to change via community governance from time to time.

How to Get $INSUR

Buy $INSUR

$INSUR tokens have been listed on the exchanges set out below.

Centralized Exchanges:

Decentralized Exchanges:

Add $INSUR to your wallet

Open your wallet and select "Add Token"

Select "Custom Token"

Paste the contract address below into "Token Contract Address".

Click "Next", followed by "Add Tokens".

That's it!

Bridge $INSUR

The InsurAce protocol's official bridge provides bridging services, allowing users to transfer $INSUR tokens between the Ethereum, BNB Smart Chain, Polygon, and Avalanche networks.

Checkout this user guide on how to use the bridge:

View market data

Market data and information for $INSUR tokens can be found on these sites.

For more information, please refer to this page.

Last updated