FAQs

Frequently Asked Questions.

About InsurAce.io

🚀 What are the competitive advantages of InsurAce.io?

Cross-chain coverage: The InsurAce protocol currently offers full-spectrum cross-chain coverage for 140+ protocols running on Ethereum, Solana, BSC, Polygon, Fantom, Gnosis, Arbitrum, Avalanche, Harmony, Moonriver, Celo, Cronos, Boba, ICON, Ontology, Moonriver, Moonbeam, Bifrost, Aurora, Optimism and Metis. InsurAce.io also plans to expand to more public blockchains in the near future.

Multi-chain deployment: The InsurAce protocol has launched on Ethereum, BSC, Polygon, and Avalanche, and will deploy on more chains in the near future.

Portfolio-based cover: The InsurAce protocol allows users to select covers for multiple protocols running on different chains with different risk types and purchase them as one single Portfolio Cover, which will result in lower prices compared to buying covers separately.

🚀 Do I need to hold any $INSUR tokens to use the service?

The InsurAce protocol is permissionless and is developed to ensure ease of access. Users are not required to hold any $INSUR tokens to use InsurAce.io's services, although Cover Purchasers do receive $INSUR tokens/governance power when purchasing Covers from the InsurAce protocol. Anyone with a wallet that supports Ethereum, BSC, Polygon, or Avalanche network can access the the InsurAce protocol by simply connecting their wallets to the InsurAce dApp. The InsurAce protocol supports various currencies for buying covers, such as USDT, USDC, ETH, and more.

For details, please check Launch APP & Connect Wallet.

🚀 Have the InsurAce protocol's smart contracts been audited?

Smart contracts have been audited by Slowmist and PeckShield:

Cover & Claim

🚀 How to buy cover?

Please refer to How to buy cover.

🚀 Does the wallet address used to purchase cover need to be the same address used to connect to the covered smart contract?

No, the Covered Address can be different from the address used to purchase the cover ("Cover Purchase Address"). You need to enter the Covered Address at the time of purchase. After that, you will not able to change the covered wallet address so please ensure you have provided InsurAce.io with the correct Covered Address.

If the Covered Address in which the loss incurred is different from the address used to purchase the cover, during claim submission, you will also need to prove that you have ownership over the Covered Address by making a transaction of $1 USD worth of stablecoin from the Covered Address to the Cover Purchase Address and back to the Covered Address within 7 days after claims submission. Otherwise, your claim will automatically be invalid and rejected.

🚀 How is the claim assessed?

Please refer to the Claim Assessment Process for each cover product.

You can also read the post-mortems of claims here: Claim Records.

🚀 What are the benefits and how can I participate as a Claim Assessor?

Please refer to Become an Assessor.

Mining (Stake & Unstake)

🚀 What are the risks of underwriting mining?

Please refer to Staking Risks.

🚀 Is there a lock-up for staking?

Please refer to Staking Risks.

🚀 How will the mining reward be paid? And how to claim the reward?

Please refer to Harvest Rewards.

$INSUR Token

🚀 What are the use cases and incentive mechanisms for $INSUR tokens?

Please refer to Tokenomics.

🚀 What is the $INSUR token distribution plan?

Please refer to Tokenomics.

🚀 What are the contract address for INSUR?

Please refer to Get $INSUR.

🚀 Where can I trade INSUR?

Please refer to Get $INSUR.

🚀 Where to find market data for INSUR? (Price, circulating supply, etc.)

Please refer to Get $INSUR.

Technical Issues

🚀 How can I deal with errors?

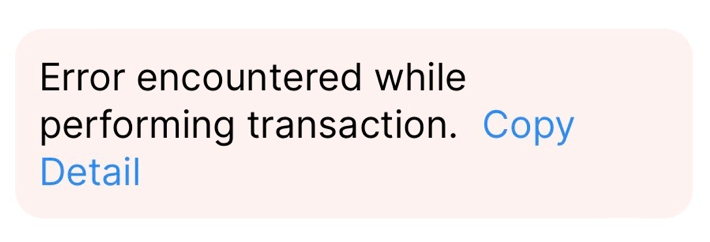

Should you encounter an error while interacting with the InsurAce dApp and find yourself unable to resolve the issue, kindly:

Click "Copy Details" in the error notification message.

Paste the details in a text file (e.g. open notepad and paste details by pressing ctrl + V or right click to "Paste") and save it.

Send error details to the admin in InsurAce's Telegram and Discord group.

🚀 How can I set spending limits on my wallet when making a transaction on the platform?

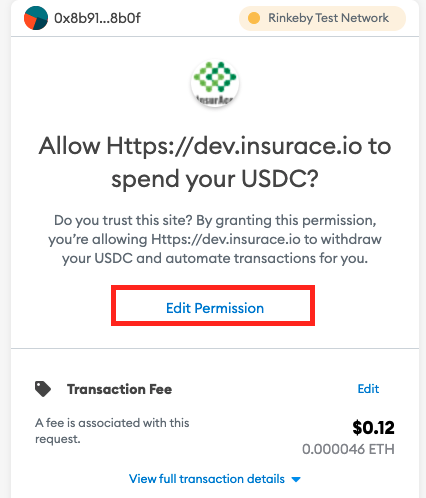

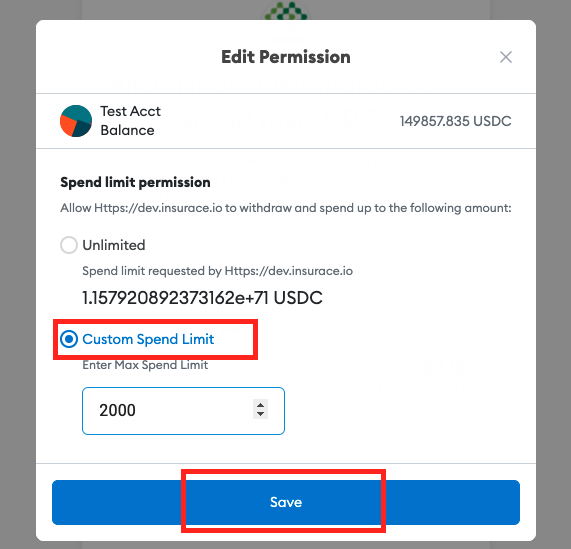

Here we use MetaMask wallet as an example:

After you have clicked the "unlock" button, before confirming the transaction in the wallet, select "Edit Permission".

Select "Custom Spend Limit" and enter the amount you wish to spend.

Please ensure the amount you enter is larger than the amount required to make cover payment. (eg. spend limit should be larger than the cover payment + transaction fees)

Click "Save", then you're done!

🚀 How to solve data display issues with the Polygon network?

If you are unable to view the data after staking and/or purchasing Cover through InsurAce on Polygon, please refer to the troubleshooting guide below:

👉 How to troubleshoot and solve the data display issue with the Polygon network?

Others

🚀 How to earn $INSUR token rewards?

Users can earn $INSUR token rewards through:

Mining: Stake assets in underwriting mining or liquidity mining pools.

👉 Details: Underwriting Mining and Liquidity Mining

Claim Assessment: Vote on claims as a community Claim Assessor.

👉 Details: Claim assessor

Referral & Earn Program: Refer InsurAce.io and cover products to friends.

👉 Details: Referral Program

Cover Purchase: Use the referral code when purchasing covers to get a 5% rebate.

👉 Details: Referral Program

Last updated