What is InsurAce.io

Product concept and positioning.

InsurAce.io is a globally decentralized protocol that allows users to purchase mutual protection for their digital assets against losses from hacking, smart contract bugs, stable-coin de-peg, or other forms of digital asset related risks.

Risk is currently shared in two mutual pools under the InsurAce protocol (cover payment pool and underwriting mining pool) which are governed by its members where membership rights are represented by the $INSUR token. As such, InsurAce.io may be described as a mutual.

At InsurAce.io. covers are issued by the InsurAce protocol's smart contracts rather than a centralized entity. When purchasing Covers and submitting Claims on the InsurAce.io platform, the ease and seamless experience of the entire process removes the need for a person, agent, or any intermediary for that matter to facilitate an introduction, propose, or advise on the merits of the Covers to users. The entire cover purchase and claims submission process is completed by the users on their own. Furthermore, the claim administration and assessment process is decentralized and governed by community voting and expert investigations.

Unique Selling Proposition

The InsurAce protocol was built to meet strong market demand for multi-chain covers and fill in the gap for portfolio-based protection. The InsurAce protocol's four unique propositions are: "0" Cover Payment, Enriched Product Line, SCR Mining and Sustainable Return.

"0" Cover Payment

InsurAce.io reduce prices by designing risk diversification into the InsurAce protocol's portfolio-centric products. Other protocol features include unique pricing models optimizing cover cost, access to domain expertise, and investments which help to offset cover cost which enables the InsurAce protocol to offer its products at low prices.

Enriched Product Line

Unlike the single protocol-based coverage of other cover providers, InsurAce.io offers a unique portfolio-based approach which can cover a basket of DeFi protocols, creating a diversified risk management tool for DeFi investors.

Despite the fact that Ethereum is the dominant blockchain for DeFi protocols, successful DeFi projects have also launched on other blockchains. InsurAce.io has expanded its services to cover protocols outside of Ethereum so that users can continue to invest freely and safely.

Anyone with a digital wallet has permissionless access to the InsurAce protocol to utilize its services such as buying covers, staking assets, making claims, and more.

SCR Mining

InsurAce.io features a distinctive SCR mining program where participants earn $INSUR tokens by staking underwriting capital into the mining pool.

The underwriting capital is managed through the InsurAce protocol's rigorous risk control models and dynamic Solvency Capital Requirement (SCR) adjustments. Any secure and free capital will be used to generate investment returns which also helps manage the rate of INSUR emission.

Sustainable Returns

Low investment returns have been a significant problem for cover providers such as Nexus Mutual since its investment returns to capital providers comes from cover payments, which have relatively low yield compared to lending and borrowing platforms such as Aave and Compound. Such low returns discourages liquidity provision from capital providers, thereby exacerbating other issues such as high prices and limited cover capacity.

Through InsurAce.io, underwriters will be able to enjoy investment returns from multiple avenues, including:

Directly investing in investment products of various risk levels.

Staking in the InsurAce protocol's mining pool to earn investment yields and $INSUR token rewards.

Earning returns generated by cover payments.

InsurAce.io believes that a multi-faceted approach to investment returns and capital management is the more sustainable way to benefit both underwriters and cover purchasers alike.

Continuous Evolution

At its very core, InsurAce.io purpose is to provide a critical and much-needed service to DeFi users in a fast growing financial market. Hence in addition to the above, the InsurAce protocol will provide and continue to improve on the following:

Handling and quantifying claims fairly, instead of simply accepting or rejecting claims.

Providing extensions, increments, or transferring capabilities to existing covers.

Collaborating with other DeFi protocols to form a network of cross protections, cover syndication, and more.

Expanding and improving the InsurAce protocol's product line to better cover risks present in DeFi.

Establishing a governance structure for robust product development, efficient claim assessments, effective community engagement, token distribution, and more.

Business Model

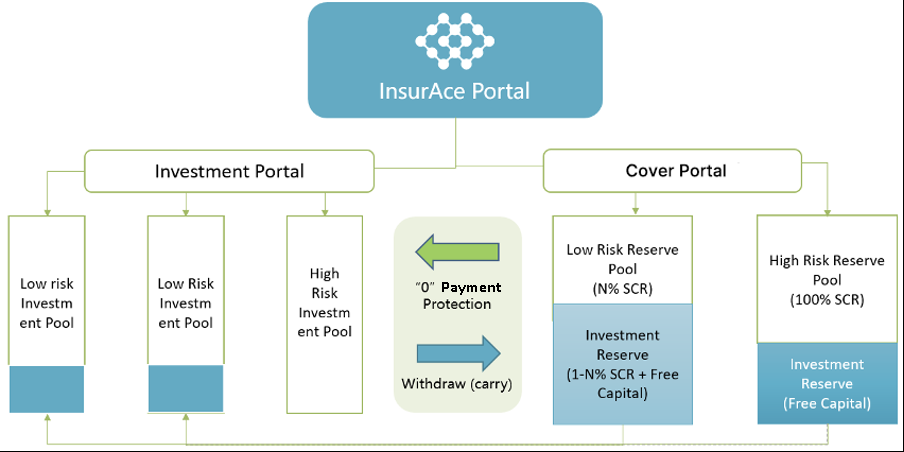

InsurAce.io provides two interoperable and functional arms: the Cover Arm and the Investment Arm.

The Cover Arm manages a capital pool which helps maintain the InsurAce protocol's solvency and therefore ability to meet its cover obligations. The Investment arm manages investment pools which generates returns in order to finance possible claim payouts and attract investment capital. Free capital in the Cover capital pool may be transferred to the Investment pool to earn higher yields and subsidize users' costs from cover payments. At the same time, the Cover Arm protects the Investment Arm.

Revenue generated from cover payments and investment returns will also contribute to the InsurAce protocol's operational and development costs, token buybacks, community incentives, ecosystem collaborations, and more.

Summary

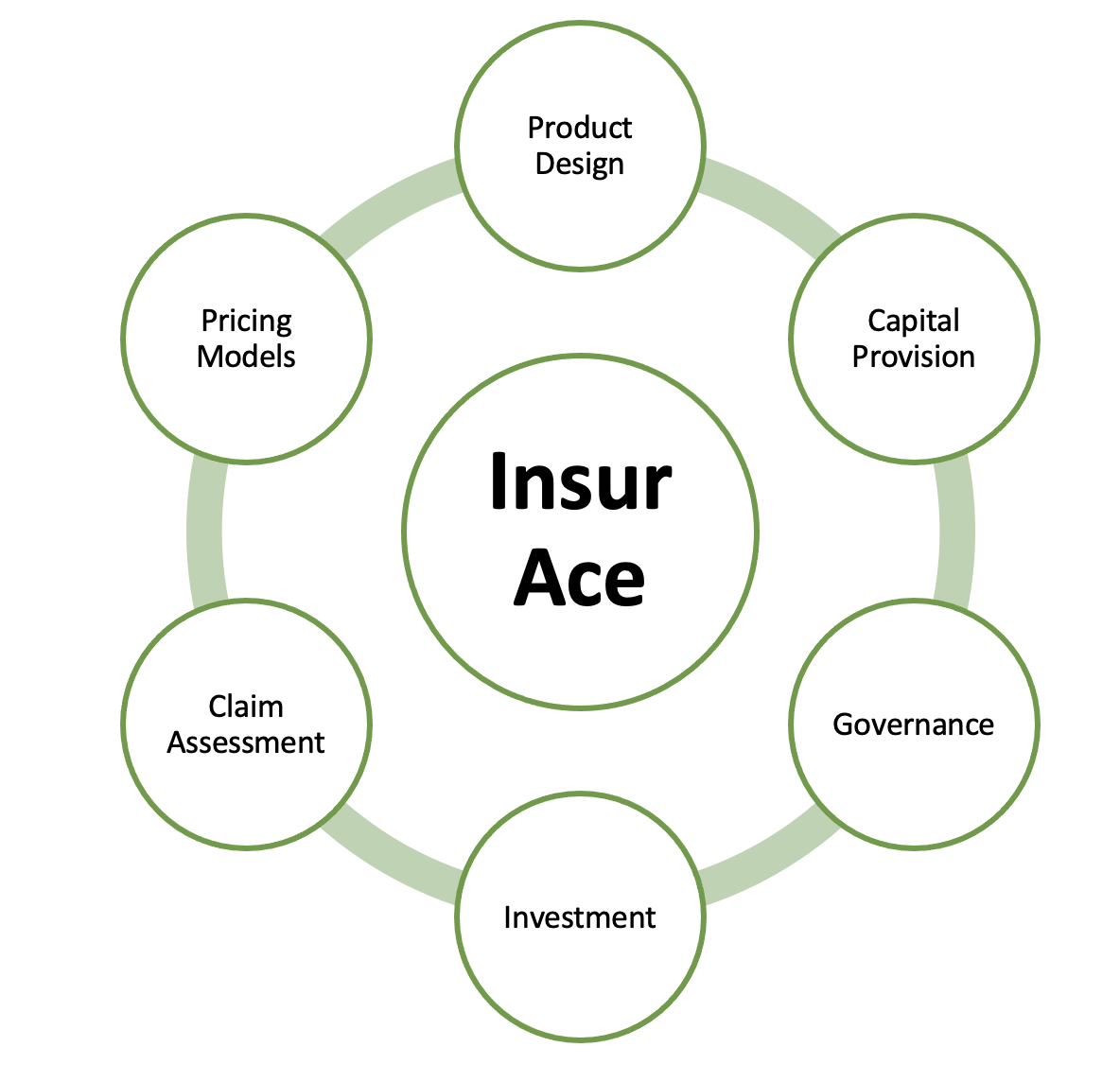

What makes InsurAce.io an effective cover provider is the sum of its parts outlined above, namely the products designed to meet market demand, adequate capital provision, effective governance, investment of free capital, a robust and efficient claims assessment process, and dynamic pricing models.

Last updated