Tokenomics Enhancements

InsurAce Tokenomics V2 Litepaper

1. Executive Summary

Tokenomics V2 is a seamless extension of InsurAce V2, focusing specifically on tokenomics enhancements and underwriting capacity expansion. It is designed to maximize the $INSUR token's use case with veTokenomics, improved token incentives, and enhanced governance. Some features of Tokenomics V2 for rollout include:

$INSUR token staking with veNFT functionality

Mining pool gauge voting

Governance optimization

Sustainable buyback & redistribution

With the above features, Tokenomics V2 aims to provide $INSUR and by extension $INSUR holders with more value. Intended knock-on effects include improved mining yield distribution, increased underwriting capacity, more competitive underwriting fee structures, and ultimately the realization of a community-driven, affordable, and accessible risk protection solution for all Web3 users.

2. Introduction

2.1. Tokenomics V1 Recap

$INSUR is InsurAce's ERC20 governance token. It currently plays a pivotal role in incentivizing user participation in the InsurAce ecosystem. Its primary features include:

Community voting on claims

Mining incentives for underwriting capital

Community and ecosystem incentives

2.2. Tokenomics V1 Challenges

While Tokenomics V1 has managed to incentivize user and underwriting participation, it does have its challenges which include:

Misaligned incentives hindering user adoption and governance

Lack of diverse and compelling use cases for long-term user engagement

3. Tokenomics V2 Overview

3.1. Overview

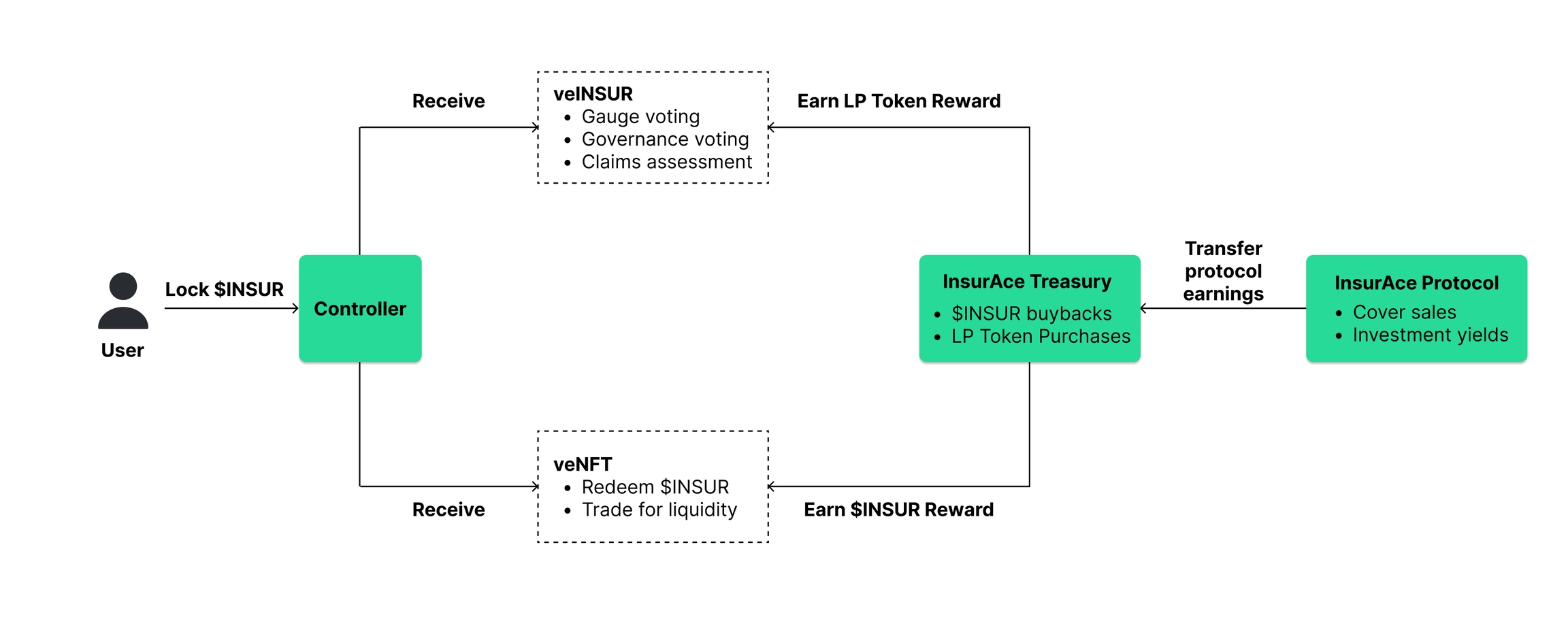

InsurAce Tokenomics V2 introduces a refined structure to optimize governance, value for long-term users, and community incentives, as shown in the diagram below.

3.2. Key Benefits

Tokenomics V2 is designed to fully engage with and unlock the full potential of the InsurAce community in order to build a comprehensive and community-driven Web3 risk protection solution. Key benefits and knock-on effects of this design include:

Enhanced Yields:

Maximize mining incentives through gauge voting

Sustainable redistribution of underwriting fees

Enhanced Utility:

Enhanced underwriting capacity with gauge voting

More efficient and competitive underwriting fee structures thanks to expanded and surgical underwriting capacity

veINSUR holder priority access to new products and features

Improved voting functions for governance over proposals and claims

4. Token & NFT veMechanics

4.1. Voting Power

"veTokens" refer to DeFi-based vote escrow tokens. They are used to govern decentralized protocols more efficiently. The vote escrow element is essentially the token holders committing their tokens to the protocol for a fixed lockup period in order to vote on proposals and incentives, thereby encouraging healthy governance over pure market speculation.

The amount of veINSUR held by a user represents his/her voting power in InsurAce's governance. Users can acquire veINSUR by locking up their $INSUR at InsurAce's governance portal. The longer the lockup period, the more veINSUR is allocated to the user. This in turn ensures that voting power and rewards are channeled to InsurAce's most committed and long-term token holders.

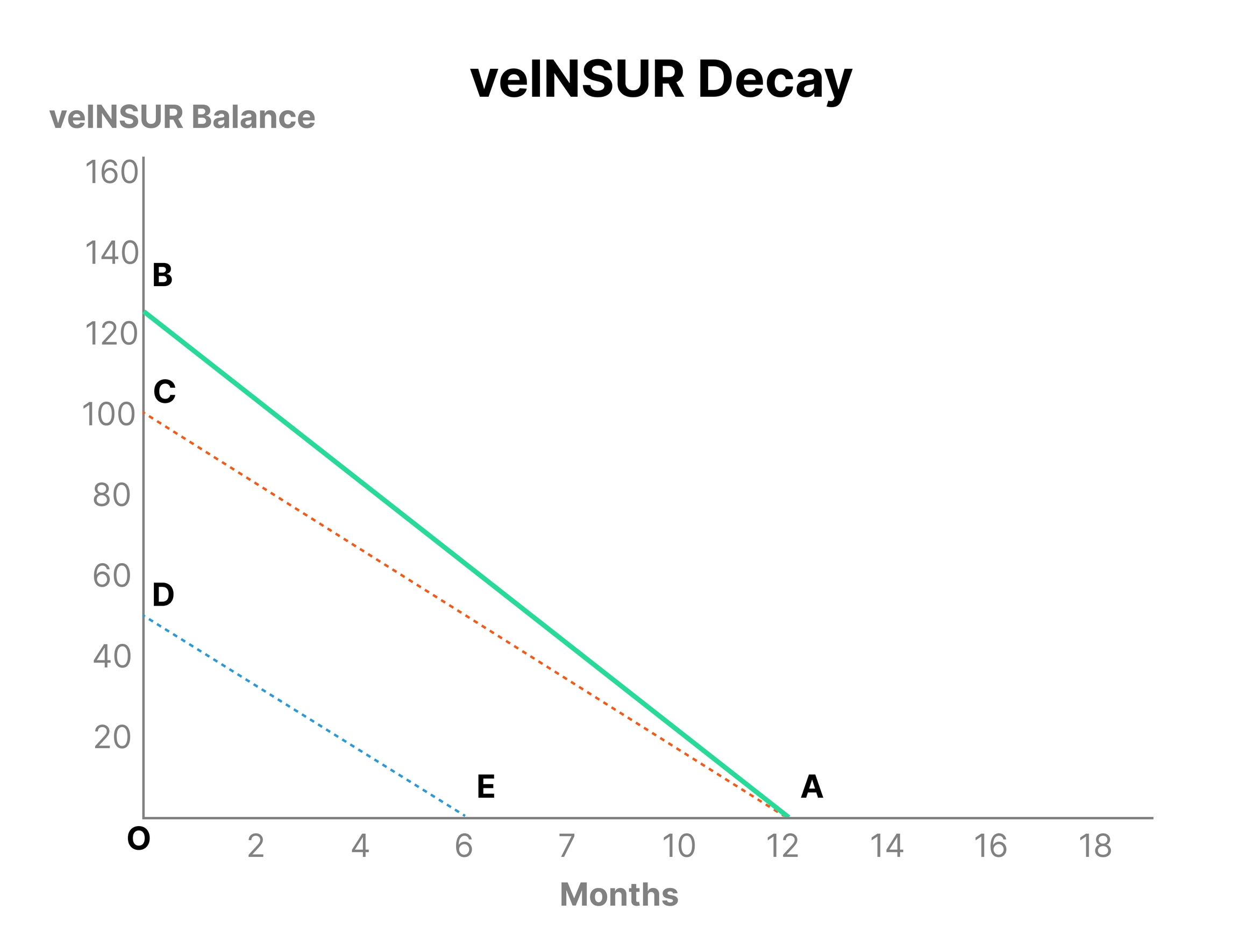

$INSUR lockups features a decay element to encourage constant lockups for maximal and sustained yield value. Each consecutive lockup extends and adds to the veINSUR holder's voting power. The veINSUR formula:

X represents the duration of the staking time in weeks, with a maximum value of 104 (i.e. 2 years).

veINSUR consolidation mechanism

The voting power obtained by the one-time staking and the existing voting power received before will be combined with the furthest expiration date following the formula as illustrated in the diagram below:

Where:

ODE - John stakes 200 $INSUR for 6 months and 50 veINSUR (voting power).

OCA - John then stakes another 200 $INSUR but this time for 12 months and 100 veINSUR (increased voting power due to longer lockup duration).

OBA - John has now staked a cumulative total of 400 $INSUR. The last lockup expiration date (i.e. end of 12 months) is applied to all 400 $INSUR which 125 veINSUR in total.

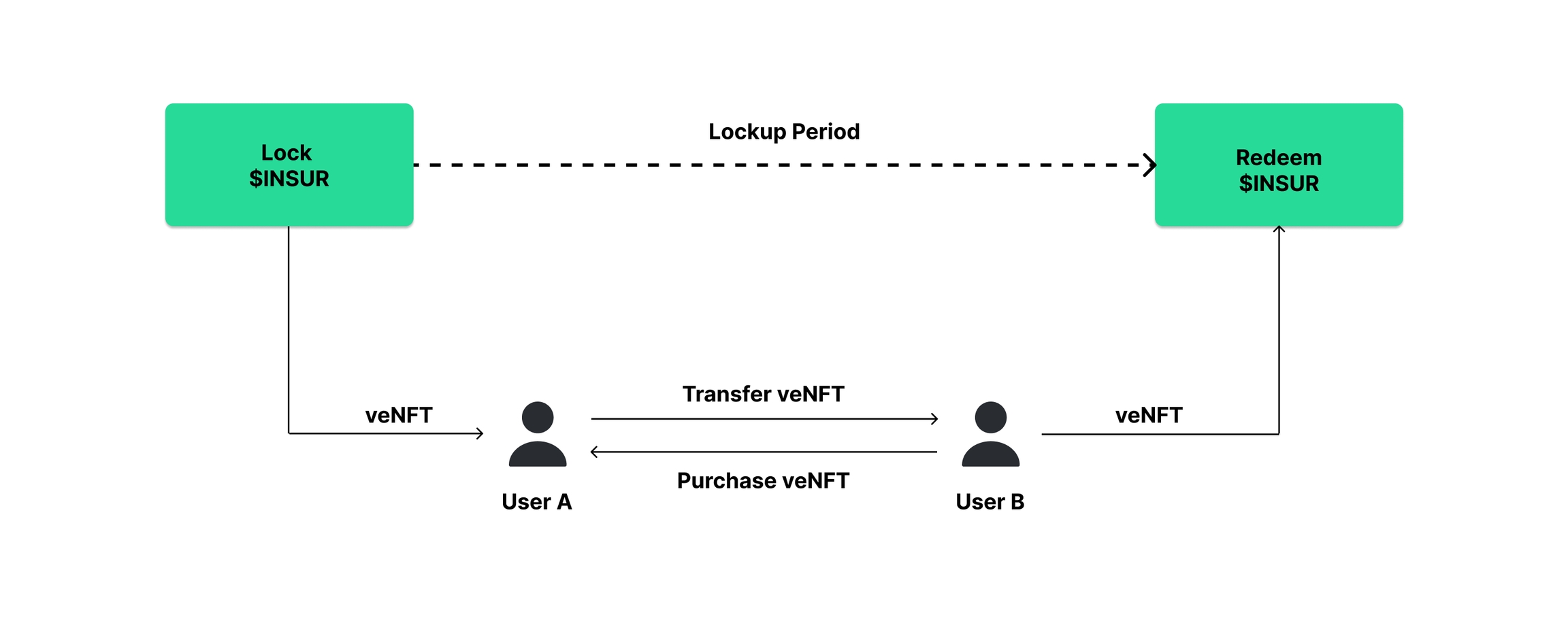

4.2. Interim Liquidity

Each time the user locks his or her $INSUR with InsurAce, he or she receives veINSUR and one veNFT. While veINSUR represents voting power, veNFT is the digital receipt required to redeem the amount of $INSUR it was locked for. Example: veNFT A was received by John for locking up 50 $INSUR until 30th May 2023. veNFT B was received by John for locking up an additional 100 $INSUR until 30th November 2023, thereby extending the lockup period for all 150 $INSUR till 30th November 2023. veNFT A can be redeemed by John for 50 $INSUR on 30th November 2023.

A critical element of this veNFT design is the divorcing of veINSUR from the veNFT. This means that a veINSUR holder is able to retain his or her rights to vote and to receive rewards for the remainder of the lockup period even after selling his or her right to redeem the locked $INSUR by selling off the veNFT. Meanwhile, the buyer of the veNFT can redeem the veNFT for $INSUR but only after the expiration of the lockup period. This design provides much-needed flexibility to veINSUR holders who may need short-term access to liquidity.

4.3. Gauge

A DeFi gauge is a straightforward way for veINSUR holders to exercise their voting power over the distribution of incentives (i.e. rewards). In InsurAce's case, gauge voting determines the distribution of both liquidity mining incentives and underwriting capacity:

Mining Pool Gauge: Amount of incentives to be distributed to a specific mining pool to attract underwriting capital to that pool

Cover Capacity Gauge: Amount of underwriting capacity to be made available to a specific cover product

Mining Pool Gauge

veINSUR holders may vote once every four-weeks on the distribution of up to 30% of mining incentives to attract liquidity to a particular mining pool. Each four-week cycle starts on the first Thursday of the cycle at 0:00 AM UTC and ends/settles on the fourth Wednesday of the cycle at 11:59:59 PM UTC. The weight allocated to each mining pool for the distribution of incentives (which influences pool APY) is determined by the percentage of total votes received by each mining pool:

The 30% limit expressed above may be refined and adjusted over time based on community feedback and sustainable development goals.

Cover Capacity Gauge

Cover Capacity refers to the amount of coverage available considering the adequacy of liquidity in InsurAce's underwriting pools for potential claim payouts. Through governance participation in the platform's Cover Capacity Gauge, veINSUR holders are able to direct more capacity to specific product offerings that they may use.

veINSUR holders may vote once every four weeks, starting with 0:00 AM UTC on the first Thursday and ending at 23:59:59 PM UTC on the fourth Wednesday of each cycle. Similar to the Mining Pool Gauge (albeit with a limit set on coverage per cover product), the weight allocated to each cover product for the adjustment of capacity is determined by the percentage of total votes received by each cover product (capped at 10% per cover product):

At the moment, up to 30% of capacity may be assigned through the Cover Capacity Gauge. The remaining 70% (or more if less than 30% were allocated via Cover Capacity Gauge) will be assigned through the platform's distribution mechanism.

To ensure the risk-bearing capability and stability of InsurAce's funds, adjustments to the capacity of individual covers will not exceed 10% of the total votable capacity allocation. The 30% limit expressed above may be refined and adjusted over time based on community feedback and sustainable development goals.

4.4. Governance

veINSUR holders have voting power to influence protocol development such as product listing, coverage options for new types of risk, and the general direction of InsurAce through governance. These voters also play a critical role in deciding claims, ensuring fair and equitable outcomes through crowd-sourced decision making. To incentivize robust governance participation, voters are rewarded with the following:

$INSUR Rewards: This is to incentivize locking $INSUR for veNFT and veINSUR. This incentive is sustained through $INSUR token buybacks with the platforms underwriting fees and investment yields. The $INSUR rewards can be redeemed with the veNFT at the end of the lockup period.

LP Token Rewards: This is to incentivize governance participation. veINSUR holders who vote on governance proposals and claims are rewarded with $INSUR-WBNB LP tokens generated through token buybacks.

4.5. Buybacks and Redistribution

$INSUR buybacks involve the periodic purchasing of $INSUR tokens on the open market using underwriting fees generated from cover sales or any investment yield earned by the platform. The purchased $INSUR tokens are redistributed to veNFT holders or paired with WBNB to form $INSUR-WBNB LP tokens. These LP tokens will be distributed to active participants in platform governance to incentivize their continued involvement and contribution to the InsurAce ecosystem.

$INSUR buybacks will be executed on the first Thursday of every four-week cycle. The amount purchased will be based on governance participation and $INSUR lock up data from the previous cycle (i.e. the amount of rewards owed to veINSUR and veNFT holders), capital pool composition, and a 20% limit on the funds used in the treasury pool for buybacks.

Meanwhile, the $INSUR and LP token rewards are distributed on the last Thursday of each of the four-week cycles. LP token rewards in particular are distributed according to the number of votes casted by each participant relative to the total votes casted in each cycle. The maximum amount of LP tokens a single governance participant may earn will be capped at 10% of the total LP token rewards to be distributed per cycle.

The $INSUR-WBNB pair can be found at: https://pancakeswap.finance/add/0x3192CCDdf1CDcE4Ff055EbC80f3F0231b86A7E30/0xbb4CdB9CBd36B01bD1cBaEBF2De08d9173bc095c?chain=bsc

5. Audit Reports

FYEO's InsurAce Tokenomics V2 security audit (Sept 2023)

Last updated